The practice of algorithmic trading, defined by the utilization of sophisticated algorithms to execute securities trades, has significantly transformed the financial sector. This comprehensive guide is designed to elucidate the critical steps involved in constructing a formidable algorithmic trading strategy, integrating established industry norms with the acumen derived from a seasoned trader's experience.

1. Formulating Hypothesis: Grasping Market Dynamics

Establishing Competitive Advantage: Formulate a hypothesis by drawing on your insights into market trends. This phase is crucial in discerning a distinctive outlook or recurring pattern that positions you advantageously relative to other market players.

2. Tool Selection: Programming Language and Broker

Strategy's Foundation: Initiate by identifying a programming language that resonates with your objectives and proficiency, such as Python, R, or C++. Concurrently, engage a broker providing extensive API support compatible with your chosen language, to guarantee the efficient facilitation of your transactions.

3. Hypothesis Testing: Strategy Programming

Conceptualization to Reality: Translate the core of your hypothesis into an operational algorithm. This initial model will serve as the cornerstone of your trading strategy, encompassing directives for trade initiation and cessation, as well as risk management protocols.

4. Backtesting: Strategy Validation

Ensuring Durability: Undertake comprehensive backtesting, ensuring your strategy is subjected to a minimum of five years of data or in excess of 10,000 trades. This rigorous evaluation is vital to ascertain the adaptability of your strategy across varying market conditions.

5. Result Analysis: Evaluating Key Metrics

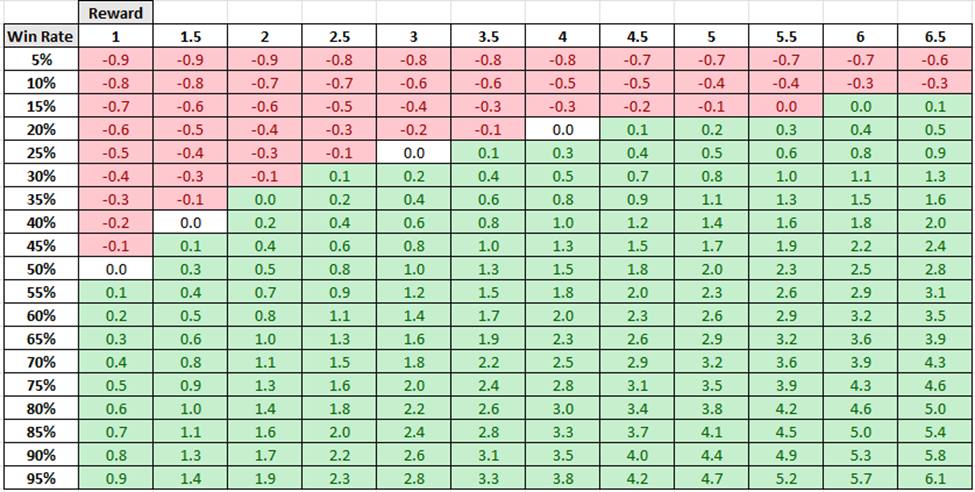

Success Appraisal: Scrutinize essential performance indicators like profitability ratio, trade volume, win/loss ratio, Maximum Favorable Excursion (MFE), and Maximum Adverse Excursion (MAE). A strategic equilibrium among these metrics is essential, applying probability principles akin to those utilized by casinos to maintain a competitive edge.

All values based on $1 risk. 2.5 Reward indicates a profit of $2.5 and a loss of $1

Credits: Build Alpha

6. Strategy Enhancement: Code Refinement

Augmenting Your Methodology: Based on your analytical findings, refine your strategy. Modifications could include trade restrictions under specific market scenarios, setting a maximum daily loss, limiting trade numbers, enhancing entry conditions, adjusting position sizes, or increasing trade frequency to augment the dynamism of your strategy.

7. Additional Backtesting and Optimization

Pursuit of Perfection: Reevaluate your strategy to ascertain enhancements and undertake optimization of critical elements. Focus on optimizing significant variables like Take Profit, Stop Loss, indicator values, or time-sensitive parameters, while conscientiously avoiding excessive optimization.

8. Iterative Refinement: Continuous Enhancement Cycle

Perpetual Advancement: Persistently cycle through steps 5, 6, and 7, engaging in a process of refinement, testing, and optimization. This ongoing cycle is instrumental in maintaining the efficacy and relevance of your strategy.

9. Cross-Market Evaluation: Versatility Assessment

Diverse Market Appraisal: Gauge your strategy’s performance across varied financial instruments and markets. This evaluation is critical in determining the versatility and robustness of your algorithm under assorted market conditions.

10. Live Testing and Ongoing Optimization

Real-World Application: Post extensive testing, cautiously implement your strategy in actual market conditions using real capital. Continually monitor, modify, and enhance your strategy in response to live market feedback and evolving market dynamics.

Conclusion

The development of a triumphant algorithmic trading strategy is an enduring process of learning, experimentation, and modification. Adhering to these steps with diligence allows for the creation of a strategy that not only endures but excels in the intricate realm of financial markets. The essence of success in algorithmic trading lies not merely in its inception but in its continuous evolution and refinement.